Evergrande finally made a fortune: two years of huge losses 812 billion, interest-bearing debt 1.70 trillion

On the evening of July 17, China Evergrande’s 2021 and 2022 annual performance reports arrived late.

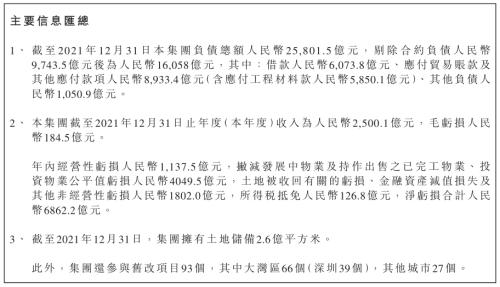

In 2021, China Evergrande’s annual revenue was 2500.1 billion yuan, with a gross loss of 18.45 billion yuan and a total net loss of 686.22 billion yuan.

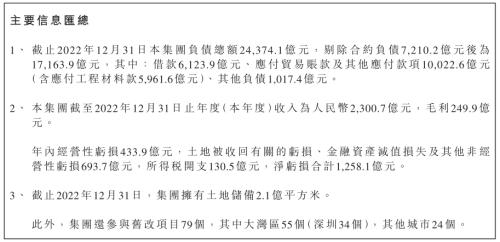

In 2022, China Evergrande’s losses were reduced due to the significant provision of losses such as asset impairment and land recovery in the previous year. That year, the company’s operating income was 2300.7 billion yuan, gross profit was 24.99 billion yuan, and net loss totaled 125.81 billion yuan.

That is to say, in the past is only two years, Hengda a total loss of housing enterprises as high as 812 billion yuan. And Hengda since 2006 financial records to 2020 a total of 15 years, all profits accumulated only 265.90 billion yuan.

In comparison, the listed companies that have been dubbed "loss kings" in China in the past, such as LeTV (loss of 13.90 billion yuan in 2017), HNA Holdings (loss of 64 billion yuan in 2020), and Kuaishou Technology (loss of 78 billion yuan in 2021), are dwarfed.

Assets shrank in 2 years 460 billion

According to the announcement, the reason why Evergrande lost so much money was not only due to operating losses, but also due to the sharp decline in the fair value of assets, the recovery of some land, and other non-operating losses.

For example, in 2021, the operating loss of the enterprise is 113.75 billion yuan, excluding the fair value loss of the developing property and the completed property and investment property for sale is 404.95 billion yuan, the loss related to the recovery of land, the impairment loss of financial assets and other non-operating losses is 180.20 billion yuan, and the income tax credit is 12.68 billion yuan.

In 2022, the operating loss of the enterprise will be 43.39 billion yuan, the loss related to land recovery, impairment loss of financial assets and other non-operating losses will be 69.37 billion yuan, the income tax expenditure will be 13.05 billion yuan, and the accumulated net loss will be 125.81 billion yuan.

In terms of debt, as of December 31, 2022, Hengda’s total debt was 2.44 trillion yuan, excluding 721.02 billion yuan of contract debt, that is, interest-bearing debt was still as high as 1.72 trillion yuan.

Among them, loans from banks and other Financial Institution Group 612.39 billion yuan, trade accounts payable and other payables 1.00226 trillion yuan (including 596.16 billion yuan payable for engineering materials), other liabilities 101.74 billion yuan.

In terms of corresponding assets, as of the end of 2022, China Evergrande held assets worth 1.84 trillion yuan, compared with 2.30 trillion yuan at the end of 2020, a direct decrease of 460 billion yuan. Among them, the property under development is the main project, the amount is as high as 1.14 trillion yuan, and the cash and cash equivalents are only 4.334 billion yuan. According to China Evergrande, as of December 31, 2022, the Group has 210 million square meters of land reserves. In addition, the Group has also participated in 79 old renovation projects, including 55 in the Greater Bay Area (34 in Shenzhen) and 24 in other cities.

China Evergrande insists that its large and high-quality land bank is a solid foundation for the group to guarantee the delivery of buildings, gradually pay off debts and resume normal operations.

However, the reality is that the company is currently in a serious insolvent state, with net assets of – 473.10 billion yuan.

Even so, China Evergrande still said that looking to the future, the company will make every effort to ensure the steady and orderly progress of key work such as "Baojiao Building", do a good job in the sustainable operation of new energy vehicles, property services and other sectors, explore the efficient disposal and effective revitalization of the company’s core assets, and steadily promote risk mitigation.

Auditor’s qualified opinion to be resolved

It is worth mentioning that the reason why Evergrande is so eager to reissue the performance reports of the past two fiscal years is largely to complete the important preconditions for the resumption of its stock trading as soon as possible, and to do its best to avoid the fate of delisting.

China Evergrande shares have been suspended from trading on the Stock Exchange since March 21, 2022. According to the listing rules, the Stock Exchange has the right to delist any securities that have been suspended for 18 consecutive months. The deadline for China Evergrande will expire on September 20, 2023.

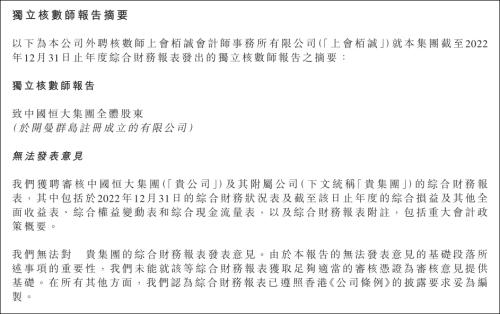

And if a company wants to resume trading, the reissue of financial reports is only one of the necessary conditions. The mountain in front of it is to resolve the issue of auditor reservations, which may also be the main factor behind Evergrande’s previous replacement of auditors and the difficulty in reporting.

In response to China Evergrande’s 2022 financial report, its auditor, Shanghai Parkson, said it was "unable to comment". Shanghai Parkson’s reasons were mainly based on two aspects, one is that China Evergrande has a number of uncertainties about continuing operations, and the other is that China Evergrande’s opening balance and comparative figures may have been misstated.

With regard to the uncertainties of going concern, Shanghui Baicheng pointed out that China Evergrande not only has high losses and high liabilities, but also involves a number of litigation and arbitration cases. These circumstances indicate that there are significant uncertainties that may raise significant doubts about China Evergrande’s ability to continue as a going concern, and therefore it may not be able to realize its assets and settle its liabilities in the normal course of business.

The announcement disclosed that as of December 31, 2022, the number of pending proceedings of China Evergrande’s target amount of more than 30 million yuan was as high as 1519, and the total amount of the target amount was about 395.40 billion yuan.

At the same time, Evergrande also admitted that various parties have so far filed lawsuits against the Group for the settlement of outstanding loans, payable works and daily operating expenses, delayed delivery of various projects and other matters. The directors have assessed the impact of the above litigation matters on the Group’s consolidated financial statements and the accrued provisions in the consolidated financial statements for the year ended 31 December 2022. The Group is also actively communicating with the relevant creditors to seek various ways to resolve these lawsuits. The directors believe that the litigation (whether individually or jointly) will not have a material adverse impact on the Group’s operating results, cash flow and financial position at this stage.

As at 31 December 2022, the Group’s material contingent liabilities were approximately 46.78 billion yuan.

Regarding the second factor, it is "explicit" that Evergrande has the possibility of financial fraud.

Shanghui Baicheng pointed out that due to the loss of Hengda personnel and Shanghui Baicheng’s inability to obtain sufficient and appropriate audit certificates for the changes in accounting treatment, as the basis for the audit opinion on the 2021 consolidated financial statements, only the limitations on the scope of the audit will no longer affect the current year figures in the 2022 consolidated financial statements.

However, comparative figures presented in the consolidated statement of profit and loss and other comprehensive income, the consolidated statement of changes in equity, and the consolidated statement of cash flows may contain material misstatements and therefore may not be comparable to current year figures.

Due to the lack of sufficient financial information referred to above, Shanghai Baicheng cannot be satisfied that appropriate books have been maintained to truly and fairly reflect Evergrande’s affairs.

Therefore, for Evergrande, it is still not an easy task to resume trading.